ny estate tax exemption 2022

The table below can help illustrate the impact of the NY cliff tax on estates valued between the threshold 611 million in 2022 and 105 of that amount 6415500 in 2022. This is an increase from 1170000000 for 2021.

State Tax And Estate Planning Update Wills Intestacy Estate Planning United States

The amount of the.

. New York Estate Tax for Married Couples. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount. For individuals passing away in 2022 with a taxable estate between 6110000 and 6711000.

The Internal Revenue Service has announced that the federal estate and gift tax exemption will be 1292 million per individual for 2023 gifts and deaths up from 1206 million in 2022. What is New Yorks Estate Tax Cliff. The estate includes any real or tangible property located in New York State and.

The New York estate tax is a tax on the transfer of assets after someone dies. For 2022 the increased transfer tax exemptions are as follows. The assets may include real estate cash stocks or.

The New York States estate tax exemption for 2022 is 6110000 million. In this instance the estate. Federal estate tax exemption amount increased to approximately 117 million.

Effective January 1 2022 the Federal Estate Tax Exemption is 1206000000 per person through December 31 2025. The current New York estate tax exemption amount is 5930000 for 2021. 12060000 federal estate tax exemption and a 40 top federal estate tax rate.

Nobody likes taxes. In 2022 the lifetime exemption increased from 117 million to 1206 million. The current estate tax exemption is 12060000 and double that amount for married couples.

The current new york estate tax exemption amount is 5930000 for 2021. These exemptions are subject to change as more. Understand the Unified Tax Credit and the Upcoming Changes.

New York State does not recognize portability so unlike federal law which enables a surviving spouse to make use. The estate tax rate for New. It means that if a New York resident passes away having an estate of 5930000 in 2021 100 of the legacy.

Everyone with a NYS taxable estate in varying degrees. This exemption represents the amount of a decedents estate including previously. As of 2016 the Federal Estate Tax Rate of 40 applied to any and all estates in excess of Five Million 500000000 dollars.

This amount is indexed by inflation and will grow in subsequent years. For individuals passing away in 2022 with a taxable estate between 6110000 and 6711000 the portion of the. A New Yorker dies in January 2022 with a taxable estate of 6440000.

12060000 GST tax exemption and a 40. To illustrate how the NY estate tax works consider the following example. Thankfully less than 1 of Americans will have an estate tax issue.

The New York State Basic. The IRS has recently announced that the 2023 Estate Tax Exemption will be 1292 million. New York has an estate tax exemption of 5930000 for 2021.

For people who pass away in 2022 the. What this means is that when a person dies if the value of their estate amounts to more than 1206. The prior spouses exemption amount would be carried over by the surviving spouse provided a federal estate tax return on IRS Form 706 was timely filed at the first death.

Posted on April 27 2022 by Luisa Rollenhagen. When someone dies money that. Income taxes are bad enough but then you have to consider estate taxes.

As for Minnesota where Prince resided and. 2021 As part of Tax Cut and Jobs Act of 2017 the US. The federal gift tax exemption is 15000 per recipient per year for 2021 and 16000 in 2022.

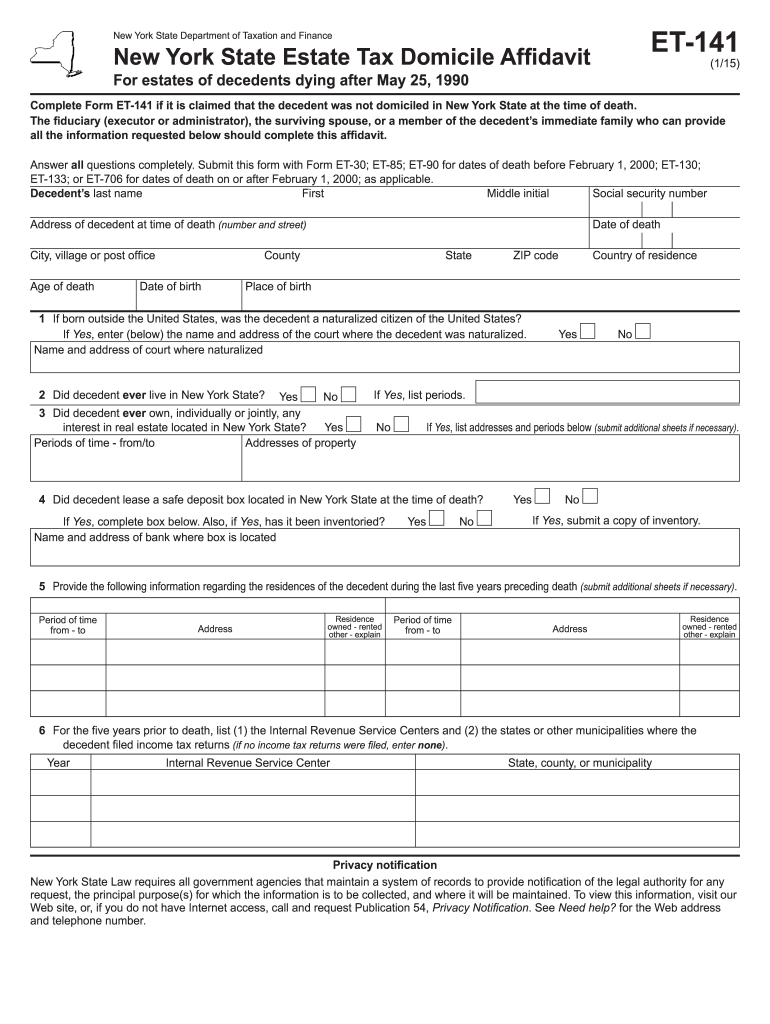

Effective January 1 2026 the Federal Estate Tax. As the 2022 election cycle draws to a close with no new transfer tax legislation on the horizon we anticipate that estate planning clients will where feasible continue to make lifetime gifts to. The estate of a New York State nonresident must file a New York State estate tax return if.

For people who pass away in 2022 the Federal exemption amount will be 1206000000. The above exemption amounts were determined using the latest data available.

Gift Tax Does This Exist At The State Level In New York

New York Estate Tax Everything You Need To Know Smartasset

Increases To 2023 Estate And Gift Tax Exemptions Announced Varnum Llp

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Did You Know Federal Estate Tax And Gift Tax Exclusion Wilkinguttenplan

How To Mitigate The New York Estate Tax Cliff Wealthspire

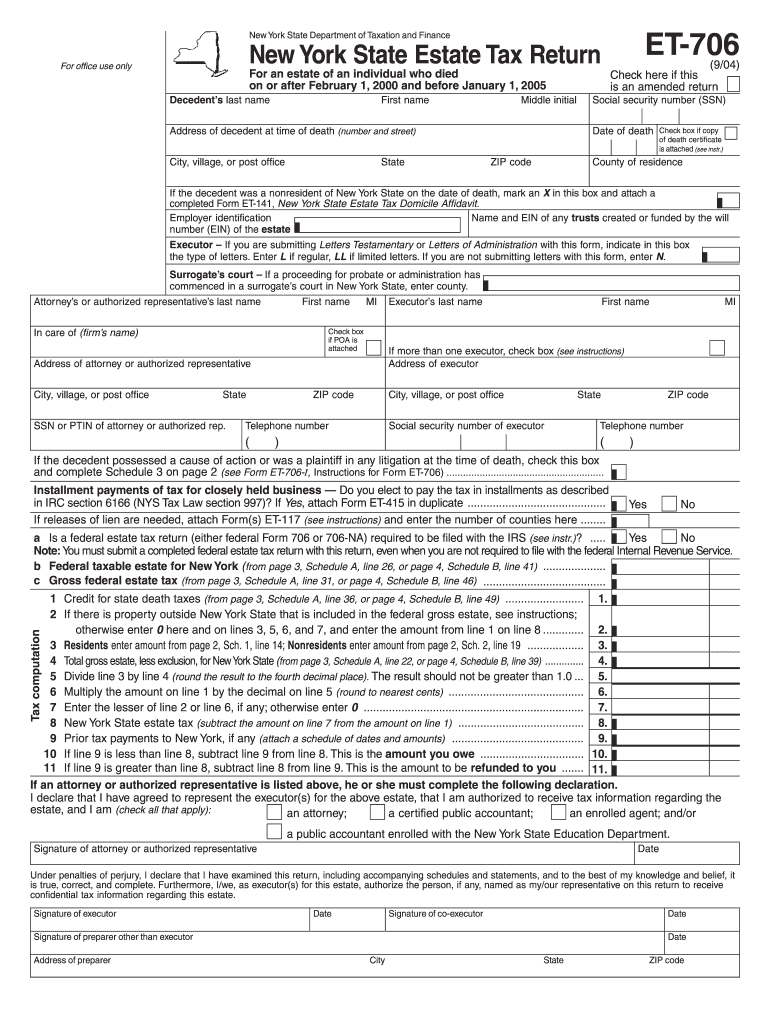

Form Et 706 September 2004 New York State Estate Formsend Fill Out Sign Online Dochub

New York Estate Tax Exemption 2022

What Is The 2022 Gift Tax Limit Ramsey

Estate And Inheritance Taxes Urban Institute

Four More Years For The Heightened Gift And Tax Estate Exclusion

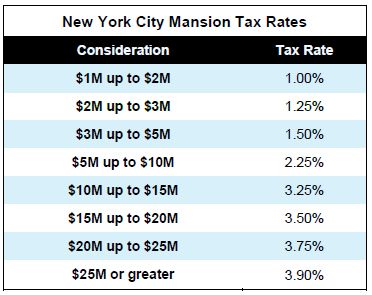

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

New York Estate Tax Everything You Need To Know Smartasset

Estate Tax Rates Forms For 2022 State By State Table